Federal Investment Tax Credit (ITC)

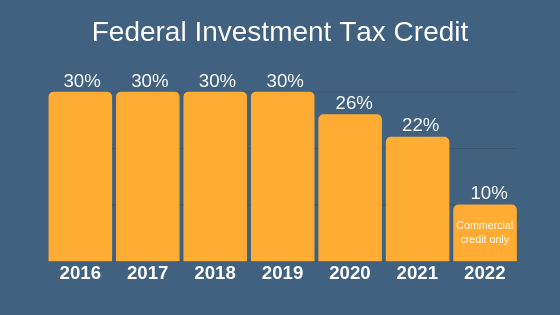

The federal investment tax credit (ITC), sometimes referred to as the

solar tax credit, allows you to deduct a percent of the total cost of installing a solar energy system from your federal taxes. There is no cap on the value, and the ITC applies to both residential and commercial installations.

The credit percentage is currently at 30%, however, it will be reduced to 26% starting in 2020, and reduced once more to 22% in 2021 before expiring in 2022 for residential installations.

After 2021, there will be a permanent credit of 10% for commercial systems only.

(NOTE: This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction.)